I recently published something at the Tokyo Review that looks at broader strategic considerations pertinent to Japan permitting the Self-Defense Forces to conduct long-range strike missions against ballistic missile positions in foreign territory (North Korea). However, I felt the technical and tactical details were also important to consider when evaluating the possibility that Japan might explicitly allow its military to exercise the use of force inside the territory of another country for the first time since World War II.

Starting with weapon systems, for many years the Tomahawk Land Attack Cruise Missile has been the main focus of Japanese hawks who believe Japan should be able to project power into the territories of other countries. On paper, the Tomahawk addresses Japan’s military need for a precise, limited but effective at-launch strike option against North Korean missile positions. The Tomahawk is battle-proven and accurate, has a small to medium radar cross-section as it skims along the surface, and its turbofan propulsion means that little heat is emitted for infrared detection. Requiring only minor modification of the Mk41 VLS already onboard Japan’s so-called ‘Aegis’ destroyers, ship-launched Tomahawks could enable long-range strikes against North Korean missile positions without putting the JSDF in harm’s way like fighter-launched strikes would. Furthermore, a Tomahawk ($1.8 million for Block IV) is considerably cheaper than a SM-3 Block IIA BMD interceptor ($18.4 million).

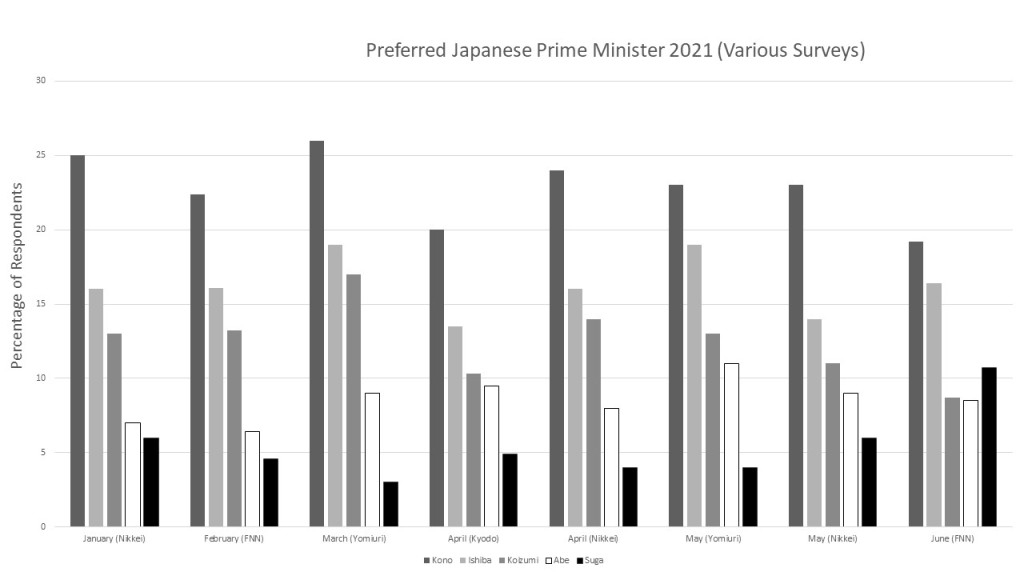

Not everyone—including former defense ministers—is convinced of the immediate need for Japan to field Tomahawks for ‘missile interdiction’ missions, however. Despite his past advocacy, even renown military otaku (and former defense minister) Ishiba Shigeru is questioning the contemporary wisdom of Japan pursuing long-range strike capabilities for missile defense missions. As Ishiba, current defense minister Kono Taro, and most commentators recognize, missile acquisition would be the easy and relatively inexpensive part of any autonomous Japanese strike capability. However, an increasingly contested East Asian aerial and maritime environment where the People’s Republic of China (PRC) and North Korea are fielding solid-fueled intermediate range ballistic missiles launchable from tracked TELS (maneuverable, multi-terrain and reusable mobile launch platforms), greatly complicates the effectiveness of pre-launch long-range strike missions. Japan’s East Asian adversaries now require fewer support vehicles and less preparation time to launch ballistic missiles (as little as five minutes), have greater choice of launch location, and can take advantage of concealment. Even if launch locations are detected, the ‘mere’ subsonic speed of the Tomahawk also gives well organized adversaries time to react and intercept, especially if launched from the Tomahawk’s supposedly ‘safer’ outer ranges.

The Japanese government will therefore need to purchase and acquire familiarity with large numbers of high-end, high maintenance and expensive support systems to have even partial success. These support systems include strategic early warning satellites, ISR-enabled airborne systems to identify, locate, and track targets once warned, the ability to suppress enemy air defences and the destruction of radar installations, robust cyber and electromagnetic capabilities (both offensive and defensive), the ability to intercept and interfere with enemy communications, and the ability to sustain firepower beyond a single decisive attack.

Japan has already started (E-767 AWACS, E-2D Advanced Hawkeye, KC-46A in-air refuelling tanker aircraft) or thought about acquiring systems (EA-18G Growler, Global Hawk) that can perform useful roles in such missions. Much greater unit numbers will be needed than the SDF currently possesses, however, as well as more UAVs and loitering munitions. This is due to distribution, disaggregation and redundancy requirements in a contested air environment. Assuming Japan pays the initial outlays or guarantees access to all of the necessary equipment, simply maintaining this all could still come to about US$1 billion dollars a year.

Furthermore, these support systems will still need to operate in these contested air and maritime domains while trying to identify and track North Korean missile positions. Trade-offs in terms of operational proximity to the adversary’s territory, effectiveness, and safety will remain an issue. Base hardening and the building of underground tunnels, hangars and military facilities by North Korea (and the PRC) also further complicates the likelihood of success. Support systems or not, cruise missile-enabled strike is not going to be very useful against submarine-launched missiles.

Experts are ultimately sceptical that pre-empting a missile attack is a viable mission, and even a ‘Nodong hunt’ to remove threats after an initial attack will likely be only partially successful—at best. This strike capability will certainly not be the silver bullet some proponents advertise to the public. Jimbo Ken outlines the most plausible scenario for Japan attacking North Korean missile positions: a combination of layered BMD plus long-range strike on overseas military assets playing some role in limiting damage to Japanese and American bases after an initial saturation attack. Takahashi Sugio also notes potential value for Japan where the United States decides to prioritize missiles targeted at US-ROK facilities in South Korea.

However, even for missile defence-focused mitigation there is a priority hierarchy. First, traditional interceptor-based BMD is essential to minimize as much damage as possible from an initial saturation attack on Japanese and/or American positions in Japan. Second, dispersing bases, airfields, and ports, wider distribution (deceptively, if need be) of units, equipment, fuel and ammunition, and in general building in resilience or survivability to US-Japan military posture on the Japanese archipelago, are all essential on the assumption that some missiles—or perhaps many if Aegis Ashore remains cancelled—will make it through the midcourse and terminal layers of alliance BMD. With the former two priorities addressed, and the alliance still able to function, a Japanese long-range strike capability could then contribute to suppressant effects by disrupting the rate and simultaneity of subsequent attacks, as well as decrease the raw number of attack nodes capable of striking military positions in Japan. This would in turn increase the possibility of interception.

For pure geographical reasons, Japan has the most important, alliance-enhancing role to play for the first two priorities, while the third would be an incredibly taxing mission to undertake from Japan. The United States is by far better positioned to address the third priority (cooperating with the Republic of Korea) due to its ROK operational bases and better chances to establish air dominance over the Korean Peninsula, as well as the capability to inflict greater damage on North Korea. The full costs of implementing a robust and credible long-range strike capability for ‘missile interdiction’ (ミサイル阻止) need to be considered alongside the fact that such missions are likely to be exercises in mitigation and may not be the best use of resources to support the alliance.

Foreign territory strike also raises some politically tricky questions regarding command-and-control structures for Japan, and not only with the United States. The US-Japan alliance does not currently have a combined command system to be activated during wartime like the US-ROK alliance does. The relationship with South Korea will also have to be enhanced in advance, as the United States will not want the burden of connecting disparate command and control structures during wartime. Realistically, for Japan to operate effectively in this mission, it will also need to conduct these activities from ROK bases on the Korean peninsula.

That’s a big problem. The US-Japan alliance provides essential strategic depth for the US-ROK alliance, and the US-ROK alliance could provide essential intelligence and real time information on North Korean activities as well as a forward operating launchpad for Japan during Peninsula contingencies. However, neither side appears to be willing to turn down the heat on pointed historical issues, let alone conceptualize the strategic relationship in such a constructive way—recent history suggests it may even be counterproductive to hector them into doing so.

These are all issues that the Japanese government should thoroughly consider when deciding on whether to make foreign territory strike an explicit JSDF mission, in addition to opportunity cost and budgetary limitations. The above is not an argument against Japan acquiring any long-range or ‘stand-off’ missiles. Japan is, after all, already acquiring air-launched cruise missiles with considerable ranges and developing hypersonic missiles that take advantage of boost-glide trajectories. Most notably, while lacking the Tomahawk’s range, Japan’s incoming JASSM-ER is faster, stealthier, and cheaper ($1 million unit cost). Future iterations will be capable of delivering more effective bunker busting warheads as well as Electronic Warfare packages like CHAMP.

While such missile systems could be repurposed for hitting fixed military sites in foreign territory, their main value is, however, in allowing the JSDF to operate outside or at the outer limits of the enemy’s threat envelope in anti-air or anti-ship operations or in aid of remote island defense in the East China Sea and Japan’s southwest. In any respect, when considering the purchase of new missiles like the Tomahawk or repurposing current missiles, a fuller accounting of the barriers to mission effectiveness should be undertaken before making a policy determination and investing precious resources in fleshing out new systems and missions.

Keio’s Jimbo Ken is particularly blunt on this point:

If Japan doesn’t make clear the strategic rationale for allocating scarce resources to specific security or defense priorities, there is a major risk of Japan implementing an inefficient or half-baked defense posture. For example, by introducing a strategically meaningless level of long-range strike capability while leaving the defense budget essentially as it is, the MSDF’s Aegis destroyers will be (over)burdened with missile defense duties [both missile interception and foreign country strike]. This will ultimately result in the neglect of the defense of the southwest maritime regions around Japan. It is thus easy to see how this might lead to the collapse of Japan’s overall defense portfolio.

What if this is not really about missile defense?

What if the current discussion about foreign territory strike is not really about missile defense/interdiction focused on North Korea, but something much more ambitious? After all, the alliance provides opportunities for the JSDF to access and familiarize itself with various high-end capabilities that could be a path to autonomy or a hedge against abandonment. A precautionary hedge is smart, but it still requires balancing the acquisition of high-end capabilities with continuing to do well what you do currently as an alliance contribution. Japan needs to consider what being a good ally entails more than what would be the case if military autonomy was inevitable and/or the motivating desire for Tokyo’s military enhancements. Otherwise, hedging against abandonment might become self-fulfilling. Furthermore—and at least for the time being—not all Japanese defense experts or even conservative politicians are so sensitive to idea that abandonment is imminent and perceive foregoing strike capability as a lost opportunity to hedge.

Another possible foreign territory strike mission would be targeting PRC coastal bases, ports, airfields, ammunition depots, chain-of-command systems and other fixed facilities to stunt a Chinese response at the start of a PRC-Japan maritime conflagration around the Senkaku Islands. As a pre-emptive measure, this would raise a whole lot of questions of escalation that seem absurd to consider outside of the US-Japan alliance context. In the alliance context, Japan could plausibly offer help striking fixed coastal assets where the United States might be stretched given China’s own military build-up. This, however, does little to relieve the more intense burdens the United States would have to carry in such a contingency, such as hunting mobile missile platforms or establishing maritime control/air dominance versus a Chinese posture designed to prevent just that. Enhancing Japan’s military posture and the alliance through other means, including spending more on maritime and area denial capabilities, and finding an alternative plan for Aegis Ashore and the already purchased, US$300 million SPY-7(V)1 radar, will free up the United States Navy to an even greater degree than a limited Japanese strike capability would.

A final possibility is that the Japanese government is accelerating the move from a posture based on deterrence by denial to one based on deterrence by punishment. The former is the effective communication of the willingness, ability, and preparation to prevent an opponent from achieving their immediate military goals, thus deterring the initiation of hostilities. Deterrence by punishment is the effective communication of the willingness, ability, and preparation to exact an unacceptable cost on the opponent that deters them from initiating hostilities. This might be through attacks on the political regime that weakens or removes it, destruction of both military and socio-economic infrastructure, or even national annihilation. A military posture based on deterrence by punishment would truly be a complete departure from Japan’s post-war concept of defensive defense. It is also a departure that public discussion has not touched upon. Transparency issues aside, one would have to question both the credibility and advisability of committing to conventional long-range strikes to deter nuclear-armed enemies by threatening them with unacceptable punishment. Particularly when those enemies have a much higher threshold for civilian casualties, and are probably not all that sensitive to Japanese civilian well-being given their own historic suffering at the hands of Japanese military forces and contemporary state propaganda.